Pakistan’s economy has been paralysed by an unpayable and largely unjust debt burden that is preventing the country reaching its poverty goals and hindering the development of democracy, says a new report from Jubilee Debt Campaign and Islamic Relief. Unlocking the Chains of Debt criticises the IMF for the crippling conditions attached to its loans and calls for repayments to be frozen while the legitimacy of all debts is investigated.

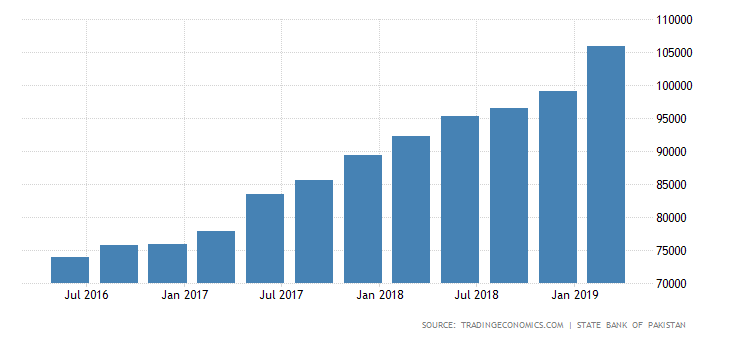

Unlocking the Chains of Debt shows that Pakistan’s government foreign debt burden has doubled since 2006 to $58 billion. It warns that annual repayments are set to increase dramatically to $6 billion a year – over 20% of export revenues, and more than half what Pakistan currently spends on health and education combined. The legitimacy of these debts is highly questionable, say the Jubilee Debt Campaign and Islamic Relief, who are calling for an immediate freeze on repayments and an audit of all debts to establish which should be paid and which should be cancelled. The repayment burden is undermining the fight against poverty and is also a serious threat to the country’s stability.

Nick Dearden, Director of Jubilee Debt Campaign, says: “The majority of debts that Pakistan supposedly owes to the world have done nothing to help the majority of the country’s people – from funding useless and damaging irrigation projects, to propping up dictators and using natural disasters to push more loans on the country. Pakistan has had enough of this kind of ‘help’ from western institutions like the IMF, which has pushed ever more unpayable loans, attached to damaging and undemocratic policies. Pakistan would be better advised to mobilise its own resources to build a more equal, balanced and stable country.â€

Dr Fayaz Ahmad, Country Director for Islamic Relief in Pakistan, says: “More than 50 million people in Pakistan live below the poverty line. Efforts to tackle poverty and meet the Millennium Development Goals are in tatters as the economy struggles to deal with the costs of devastating seasonal floods, the ‘war on terror’ and the huge burden of foreign debt. The legitimacy of the debt needs to be challenged if widespread economical turmoil and instability are to be avoided.â€

As examples of Pakistan’s unjust debt, Unlocking the Chains of Debt points to:

A failed World Bank drainage project which caused widespread environmental harm and suffering among local communities, violating World Bank safeguarding policies. $42 million has already been paid to the World Bank ($34 million of this in interest), with $231 million still owed.

Loans used to prop up military governments, including those of General Musharraf (2000-2008) and Zia-ul-Haq (1978-1988).

IMF ‘bailout’ loans. Pakistan has been subject to one of the most sustained periods of IMF lending of any country (borrowing for nearly three-quarters of all years between 1971 and 2010). Conditions have included tax reforms that increased taxes by 7% for the poorest households and reduced them by 15% for the richest.

Natural disaster loans like those given in the wake of the 2007 cyclone and the devastating floods in 2010, which should have been given as grant aid.

The ‘war on terror’, which has cost the Pakistan government between $68 billion and $80 billion, not to mention the many thousands of people killed or displaced.

Jubilee Debt Campaign and Islamic Relief are calling for:

A public audit into the legitimacy of Pakistan’s debt

A moratorium (freeze) on debt payments during the audit, with the subsequent cancellation of unjust debts

Progressive taxation reforms, to ensure that Pakistan’s wealthy contribute more to giving the government the revenue it needs to tackle poverty and increase equality

© Today's Point Online