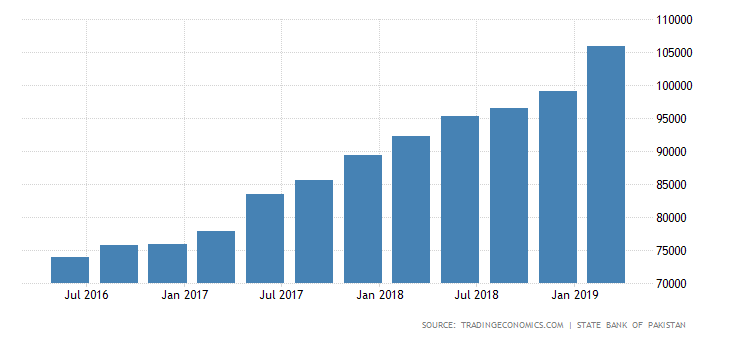

Pakistan””s rising debt is becoming unsustainable due to massive borrowing by the government to build foreign exchange reserves, opined former Advisors of Finance Ministry Dr Ashfaque Hassan Khan and Sakib Sherani here on Saturday. Speaking at the 3rd National Debt Conference organised by Policy Research Institute of Market Economy (PRIME), Dr Ashfaque stated that Pakistan””s external debt has reached $73 billion and is expected to increase to $81.3 billion by the end of 2016-17, $90 billion by 2017-18, $98 billion by 2018-19 and $110 by 2019-20.

He added that the country””s financing requirements are estimated to increase to $18 billion by 2017-18 from $15 billion projected for the current fiscal year and estimated at $22.5 billion by 2019-20. Pakistan””s debt situation is deteriorating rapidly and posing a serious threat to the country””s solvency going forward. Financing gap is expected to jump to $9 billion in 2018-19 and further to $11 billion in 2019-20 which is absolutely unsustainable. The country””s separation from the International Monetary Fund (IMF) is temporary and they may reunite in 2018-19 again. He said that share of domestic debt in public debt remained at 68.2 percent but the domestic debt is expensive as compared to external debt. This is a serious development and a matter of national security issue.

During the last three months, the government borrowed $3 billion while in three weeks $400 million were borrowed to build reserves, said Khan, adding that foreign exchange reserves are being built mostly through expensive borrowing. He further said that Pakistan added $32.7 billion in external debt during the last eight years. Added with $17 billion in the 1990s, we added $50 billion out of total external debt of $73 billion in two periods (1990s and 2008-16) or two-third of Pakistan””s external debt is added in the 1990s and 2008-16, he said.

He said that current account deficit is not high because the economic activity slowed down as demand is lower and oil prices declined. He further said that one-third exports are going to retire past borrowing. Current pace of borrowing will continue while exports are continually declining but the government is not caring about. Khan recommended that the Prime Minister should form a high-level Balance of Payment Committee to examine the developments taking place and suggest ways to come out of the crisis. “We need to develop a more effective borrowing strategy consistent with the country””s development priorities,” said Khan, adding that an appropriate borrowing strategy consistent with macroeconomic framework must include; currency mix, terms and conditions, parameters of borrowings, current account deficit, amortisation payments, reserves target and medium-term development.

Sakib Sherani said that Pakistan””s export performance is deteriorating, and dubbed the Ministry of Finance as an ostrich with its head in the ground. Pakistan””s external debt stock has risen significantly in recent past. Exports have fallen, said Sherani, adding that outlook for remittances is highly uncertain.

Asad Umer, leader of Pakistan Tehreek-e-Insaf (PTI) said that Pakistan is being caught in debt trap. There is a debt limitation act but it does not stop the government from crossing the debt limit. He blamed the government for not focusing on economic fundamentals, and also blamed Parliament for not playing its constitutional role. The country is slipping into a deteriorating territory of unsustainable debt, said Umer, adding that tax system has become redundant as tax payers are made fool while tax thieves are rewarded.

He termed the tax amnesty schemes as a total failure because, according to him, they reward tax evasion, while those who pay taxes end up suffering the most. He further said that market share of tax evaders is increasing while that of actual tax payers it is decreasing. He recommended creating autonomous tax collection body.

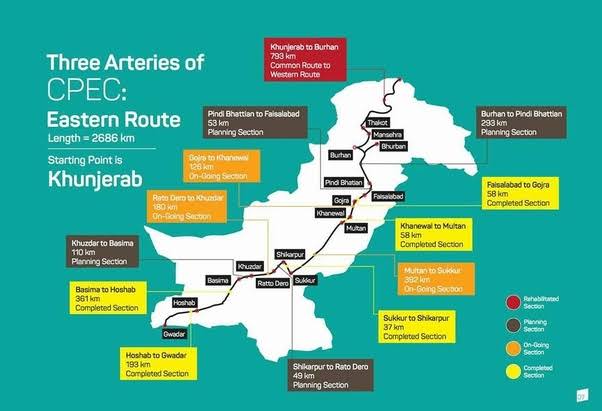

Former Governor State Bank of Pakistan, Shahid Kardar chaired the session on the sustainability of the public debt. He also expressed concerns over the rising debt. DG Central Directorate of National Savings, Zafar Masud stated that Pakistan””s debt problem was not as alarming as being portrayed, and claimed that the national debt was well under control, at least for the next 4 to 5 years. He said that public debt to GDP – Pakistan is doing better as globally it increased by over 13 percent while in Pakistan it is increased by 3 percent. Masud said that Pakistan is doing better with GDP growth as compared to emerging and developing economy. Pakistan””s risk premium declined as economy expands. He further said that CPEC is estimated to increase growth rate by 2 to 2.25 percent. The CPEC is estimated to create 2.5 million jobs from 2015 and 2030, he added.