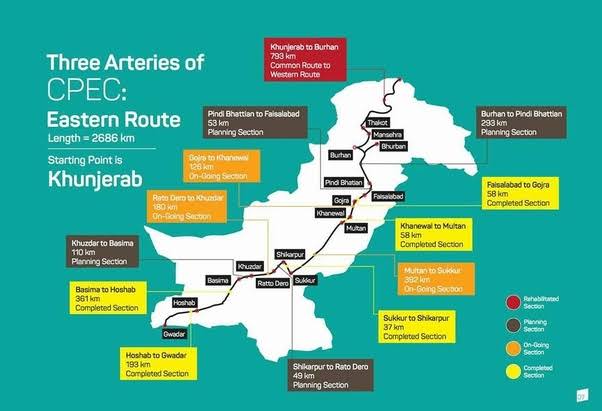

China-Pakistan Economic Corridor (CPEC) is a big business proposition with huge Chinese investments spreading over 15 years having a total outlay of up to $46 billion: $35 billion on the energy sector in the mode of IPPs (independent Power Producers) and $ 11 billion for infrastructure development; like industrial zones roads and railways etc. A good part of these investment projects comprises loans from Chinese banks, of which full details are not available, generating fears of further indebtness of already loan-riddled Pakistan. Construction of 3,218 km long route from Chinese province of Kashgar to Pakistani port of Gawadar, is seen as hallmark of this CPEC project. Through this shorter route, Chinese goods will have easier access to the Middle East, Africa and beyond. Currently these goods have to travel a long distance of around 10,000 km from the South China Sea through the Strait of Malacca |1| to reach the Gulf. A special force of 15000 Pakistani troops would protect CPEC route.

The proponents of CPEC call it a game-changer for Pakistan and this region, but people and several economists here remain skeptical about the opaqueness of projects under CPEC and particularly of the terms and conditions of loans Pakistan is acquiring from China under this grand project. |2| For govt. CPEC is Viagra to Pakistan economy, for experts it is another form of “ East India Company”. It needs a broader analysis to have a clear picture.

An objective overview suggests CPEC is not a gift from Beijing to Pakistan, rather a complicated set of infrastructure investments that will be paid for mostly by Pakistani investors, consumers, and taxpayers in the form of commercial loans from Chinese banks paid back by Pakistani power generation companies and the government, and electricity tariffs paid by ordinary Pakistani consumers.

The total CPEC cost is around $46 billion: $35bn is allocated for energy projects while $11bn is for infrastructure development; such as Gwadar port development, industrial zones and mass transit schemes etc. On top that an additional amount of $8.5 billion of investment from Beijing as part of the countries’ joint energy, transport and infrastructure plan has also been finalized, making the total cost close to $55 billion. |3| Major portion of this money is supposed to come from Chinese private banks.

The energy sector worth an investment of $ 35 billion is important area to look into and independent power producers (IPPs) the real layers are bringing coal from China despite Pakistan having huge resources of its own coal. Which means China using these projects to dump its coal in Pakistan. |4| These IPPs have also bound the government of Pakistan to buy electricity from their power houses for at least 30 years whether it needs it or not, at lot more expensive rates than the international rates or than the electricity already being produced in the country.

Some economists are of the view that availability of the energy does not mean a sudden booster to local economy and compulsory buying of electricity from IPPS would generate another vicious circle of circular Debt. |5| Infrastructure development with low level of economic activity and at the cost of accumulation of loans is a not a good deal. Pakistan is already repaying loans at an average of $5 billion per anum and further loans means a disaster for its economy. Pakistan lacks capacity to repay CPEC loans and the next global economic crisis may knock Pakistan back into a recession.

Thanks to low oil prices coupled with borrowed foreign exchange, Pakistan economy shows comparatively better indicators although momentarily. The real crisis, will hit when all of the loans Pakistani energy companies have borrowed from China, come due. The power plant payments, tariff payments, capacity payments and loan repayments would exert a lot of pressure and Pakistan economy or exports are not in a good health to bear it.

But the government of Pakistan is in no mood to consider this side of the argument and trying to convince the people not to worry about repayment obligations because it is not public debt, rather private loan being acquired by the private companies from Chinese banks.

On the other hand for China CPEC provides an alternate secure route to import energy and find new markets for its goods and services. Almost 80% of the China’s oil is currently transported from Strait of Malacca to Shanghai, (distance is almost 16,000 km and takes 2-3 months), with Gwadar port becoming operational, the distance would reduce to less than 5,000 km. This would be a great strategic benefit for China. However, for Pakistan it would definitely help counter Indian influence in the region, position itself as a major transit point connecting Eurasian region with South Asia and South East Asia.

The objective analysis suggests that the only growing demand in Pakistan at present is for language translators, while Chinese language course centers have also emerging in the big cities. Meanwhile the government has also announced to make Chinese language as part of the curriculum in government schools. However, mere Chinese language is not enough to integrate and secure the dividends, unless technological capacity of the local universities, related to quality researches, is not built.

New East India Company?

Although Chinese companies are investing a lot more as compared to the British East India Company, their character is entirely different. They are bringing in entire equipment and technology, supervisory, and skilled labor manpower from China. That means that the multiplier effect of infrastructure spending will go to Chinese companies instead of local Pakistani people.

As Exim Bank of China and China Development Bank are already lending huge sums for CPEC projects to Pakistan, a Shanghai based consortium has just bought a 40% share in the Pakistan Stock Exchange (PSX) for $85 million and will soon take charge of its management. |6| The size of market capitalization of the PSX currently is around $100 billion. |7| With this growing Chinese financial influence on Pakistani rulers, the authority of the IMF and World Bank is likely to be reduced in coming years and the Chinese ruling class has good chances to emerge as a kind of new imperialist power in this region.

So far CPEC seems a big illusion; instead of reducing poverty it would probably increase the exploitation and unemployment. If huge infrastructural projects could have reduced poverty and misery there should be no poor in China and India. Chinese trucks would roll on the road from Kashgar to Gawader, while Pakistan has to take care of maintenance and security of the road from its own pocket. This is not a good proposition.

The plan of new industries to be built along the CPEC route seems a dream as people are still waiting for the industrial zones promised to be built along the Motorway many years ago. It is claimed that CPEC project will create some 700,000 direct jobs by 2030. However, instead of creating new jobs, it is feared that CPEC may lead to the closure of local industry in Pakistan, which will not be able to compete with their Chinese rivals.

CPEC and Pakistan Debt

As part of CPEC, the govt. of Pakistan is securing loans worth approximately $11 billion from Exim Bank of China and the China Development Bank for infrastructure projects. Moreover, on top of that the government has secured an additional $8.5 billion of investment from Beijing as part of the countries’ joint energy, transport and infrastructure plan. Thus increasing the current foreign debt from about $ 73 billion to around $ 92.5 billion.

The IMF has also warned that CPEC could add to Pakistan’s medium- and long-term risks, predicting that the country’s gross external financing needs would rise to $15.1 billion in 2018-2019 from $11.4 billion in the current financial year. |8|

However, the current govt. position is that “as the economy grows, our capacity to undertake the responsibilities of repayments also improves”. Its policy is to go for higher spending through reckless borrowing. By avoiding bitter decision of reforms it is busy making the electorate happy. During last three and a half years current government has accumulated an unprecedented amount of both external as well as domestic debt, contracting $34.6 billion of new foreign loans since 2013, according to State Bank data.

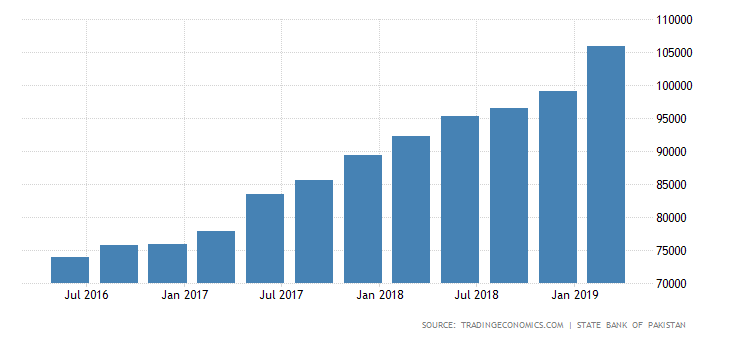

The cumulative public debt stock has increased from around Rs.14, 600 billion on June 30, 2013, to Rs20.272 billion as of end-December 2016, an increase of 40 per cent or nearly Rs.5, 700 billion. According to renowned economic expert, Dr. Ashfaq Ahmad, Pakistan’s financial requirements are getting higher by every year.

In the current budget 2016-17, Pakistan’s financial requirements amount to $15 billion; including $7billion current account deficit and $ 9 billion for debt serving, next year 2017-18, this amount would be $ 18 billion and by 2019-20, Pakistan would be requiring $22.5 billion; $10 billion for debt serving and 12.5 billion for current account deficit. The total external debt is expected to rise from current $ 73 billion to $110 billion by 2019-20.

This is a horrific picture by all means. Pakistan may be facing a Greece like situation. CPEC may not help Pakistan to meet its financial requirements in near future. The current economic infrastructure of Pakistan has not that much capacity to take maximum benefits from CPEC. It will take time. Therefore, strong chances are there Pakistan will have to go back to IMF next year.

But the govt. obsession with CPEC is so strong; that it is like ‘national anthem’ for them and all the politics ruling elite revolves around it. The real issues of unemployment, poverty, inequality, education and healthcare have been put on the back burner. Speaking against CPEC is almost taboo now.

Footnotes

|1| The Strait of Malacca or Straits of Malacca is a narrow, 850 km stretch of water between the Malay Peninsula and the Indonesian island of Sumatra

|2| http://profit.pakistantoday.com.pk/…

|3| http://nation.com.pk/business/25-No…

|4| https://www.marxist.com/pakistan-th…

|5| The circular debt or “unpaid bills” of the country`s power sector, is already back with a vengeance to haunt the government less than four years after it had paid off previously accumulated bills of Rs.480bn of private and public power producers. The current unpaid power sector bills had piled up to Rs.414bn in spite of a substantial decline of around 50pc in global oil prices over the last three years

|6| https://tribune.com.pk/story/127212…

|7| https://tribune.com.pk/story/127195…

|8| http://nation.com.pk/business/23-No…

Source: http://www.cadtm.org/Pakistan-CPEC-A-game-changer-or