Although successive governments in Pakistan have been acquiring foreign loans to meet their financial needs and all of them have their own share in pushing the nation towards a vicious and unending debt spiral, creating donor dependency by following (international financial institution (IFI)-led economic policies. However, the current PPP government has set new records of getting loans from foreign creditors and domestic banks.

When the military dictator Gen Musharraf took over in October 1999, the country’s foreign debts stood at $37.9 billion. At the end of June 2007, when Gen Musharraf was still in power, the size of foreign loans had risen to $40.5 billion. This means the foreign debt did not register much increase (thanks to debt rescheduling soon after 9/11 by creditors). The external debt liabilities stood at $22billion only till the end of the 1980s.

This shows that Pakistan’s dependence on foreign loans has been going up with the passage of time, despite consistent claims by every successive government/regime that it had done miracles to improve the economy. The current PPP government, deviating from its manifesto and the vision of the late Zulfikar Ali Bhutoo, rushed to embrace imperialist-led international financial institutions. These IFI (the money minting factories)are always ready to accommodate such clients to establish debt domination for their political agendas.

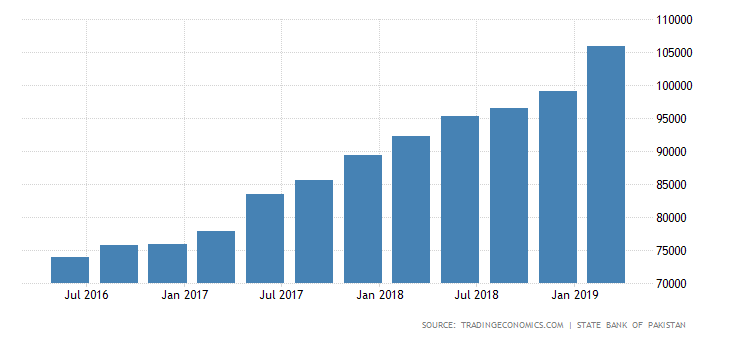

When PPP government came into power in 2008, the country’s external debt was $45 billion which has now increased to $61.5 billion; which means an enormous increase of $ 16 billion has been added to the mounting burden of public debt. Whereas domestic debt stands at round about Rs.3851 billion. {is this much less – put dollar equivalent} Thus according to simple estimations every Pakistani today is under a debt burden of around Rs. 66,000.

There is no denying the fact that in 2008, Pakistan was about to default and the PPP government had to go for an SBA agreement worth $ 11.3 billion with IMF. But as a policy matter during the last four and half years it did nothing and it could not set any agenda for public debt reduction.

What people expected from the PPP was that it would take at least some bold steps towards large scale pro-people economic reforms; like reducing the non-development and the military budget, enhancing the tax base by including the rich in the tax net, more budgetary allocations for the social sector and somehow agrarian reforms to lessen the ever widening gap between the rich and the poor.

However, like previous governments it fails to introduce any system of much-needed Progressive Taxation for resource generation and to lessen debt-dependency. Pertinent to mention is that Pakistan’s Tax to GDP ratio is the lowest in South Asia; round about 9 per cent, which needed to be increased.

The PPP government did well with regard to constitutional reforms; including the 18th Amendment, the NFC Award and progressive legislation for women empowerment, but on the economic front its dismal performance has eclipsed its constitutional victories. The PPP argument of launching the Benazir Income Support Program (BISP) for women’s social uplift is difficult to buy. This program is creating a debt burden and has little economic impact.

It has raised the prices of all public utilities manifold during its close-to-end tenure. The recent launching of two amnesty schemes, namely, the ‘Tax Registration’ and the ‘Tax Amnesty Scheme’ aimed at facilitating tax evaders and plunderers of national wealth seems nothing but a pathetic effort. This is another NRO of its own kind with the tax evaders.

With the PPP government in power, the public debt has exceeded 62 percent of the country’s GDP, and debt servicing accounts for over half of the current revenues. Per the Fiscal Responsibility and Debt Limitation Act of 2005, the government is supposed to reduce its foreign debt by 2.5 percent of GDP every year, but PPP government like her predecessors failed to realize the goal, accusing the global economic meltdown, slow foreign investment and poor economic growth on the domestic front.

The multilateral lending institutions, the Paris Club and the International Monetary Fund (IMF) are the biggest holders of Pakistan’s external debt, while the State Bank of Pakistan owns the major share of domestic debts. To avoid borrowing from IFIs or because of difficulty in securing more foreign loans, the government is buying heavily from local banks. These banks are really happy with the PPP government for providing them opportunity for safe and secure investment.

The substantial rise in the size of external debt is widely attributed to growing debt servicing, heavy public sector borrowing to finance fiscal deficit, currency depreciation, and a decline in tax revenue receipts. The data given by the Economic Survey of Pakistan 2010-11 and the State Bank of Pakistan report on Pakistan’s Debt Profile reveals that Pakistan had a better debt profile during the democratic tenures of Benazir Bhutto and Nawaz Sharif. Even the debt levels were fairly under control in the nine-year military regime of Pervez Musharraf when the country’s foreign debt had not surpassed $41 billion mark.

It was a good step on the part of the PPP government when it took the decision to say ‘adieu’ to the International Monetary Fund (IMF) program on 17 September 2011, by suspending the SBA agreement. At present, Pakistan has no operational arrangement with the IMF. However, it owes the IMF about $8 billion: $1.8 billion is due to be paid to the IMF in 2012, $3.9 billion in 2013 and $2.1 billion in 2014. Thus, in the absence of a new arrangement, Pakistan will have to repay a total net amount of $7.8 billion to the IMF in a period of less than three years.

It is obvious that at any time in the next two-three years the country may default in its payments to the IMF and/or other creditors, in the absence of another borrowing arrangement with the IMF or substantial net lending by other foreign sources. No wonder that there is again a talk in official circles of going back to the IMF for another borrowing arrangement in the foreseeable future.

Pakistan`s stock of public debt has doubled since the current PPP government came into power, but Government fiscal hawks and advisors think otherwise. To them debt is not the only indicator of a bad economic situation. When thinking about debt its better to look at the proportions, rather than the raw quantities, they argue.

These advisors tell us that the main thing is Debt-to-GDP ratio and if the government keeps this ratio under control there is no problem. They argue that debt to GDP ratio is not changing under PPP rule. In fact, over the past decade, the debt to GDP ratio has actually fallen down, from about 80 per cent at the end of the 1990s to just over 61 per cent at present.

That proportion means that Pakistan is in fact much better off, in terms of its indebtedness, than many other countries that are living through a sovereign debt crisis. In Greece, for instance, the same ratio stands at 164 per cent, for Japan it`s at 229 per cent, for Singapore 100 per cent and so on.

In fact this kind of comparison and declaring Debt to GDP ratio as the sole bench mark is misleading. How much debt is appropriate for any given country to be carrying? The answer to that question depends on the solid economic ability of that particular country to pay the costs of servicing the debt. And that is where Pakistan has a problem in debt servicing payments. More than 60 per cent of net revenue receipts of the federal government go towards debt servicing, which leaves hardly anything behind for other expenditures like health and education.

In fact Pakistan does not need any foreign aid at all. The country has been dependent on aid for decades and much of that aid has gone into supporting military dictatorships under one pretext or the other. Pakistan needs reforms, not aid. We have enough resources to be able to fill the investment gap.

Foreign aid is the easy option for the bureaucracy and politicians. The government must be able to exercise its will and tax the rich. Without changing the tax system and tax structure, the issue of rising debt is next to impossible. If the government just collects tax more efficiently and honestly, there will be no budget deficit and the country will need no more loans or aid, which are always politically tied.

The tax problem in Pakistan is becoming more and serious. The PPP government is an utter failure on this issue. It did not dare to catch the big fish and instead of introducing direct taxes it kept on increasing indirect taxes. This has hurt the poor bitterly. There is unchecked capital flight from the country to offshore tax heavens and rampant tax evasion. The tax-GDP ratio around 9 percent is lower than Afghanistan’s, and fewer people in Pakistan — a country with a population of 180 million — pay their taxes than do the people in Guatemala, which has a population of 15 million.