12 May 2019 – The Pakistan economy is in severe crisis. The newly formed government of Pakistan Tehrik-e-Insaaf (PTI) has been trying hard to convince the people that it was serious to divorce the debt dependency. However, like all the previous governments it finally capitulated to the International Monetary Fund (IMF) capitulation. As of writing these lines, the PTI-led government is imploring for a bailout package of around $ 6-7 billion.

Knowing well the weak position of the new government, the IMF has reportedly decided to further tighten the screws of the PTI government. Media reports on May 11 suggest that the IMF has insisted on inclusion of some new conditions in the program. New conditions include an increase in discount rate by at least 2% and at least 20% further devaluation of Pakistani rupee against the US dollar

Pertinent to mention: Pakistan has accepted almost all such IMF demands as flexible exchange rate, withdrawal of subsidies, containing borrowings from the Central Bank and reinitiating the privatization process. The harsh conditionalities imposed by way of previous IMF structural adjustment programs have already resulted in severe cut-backs in social spending, housing, health care and education. Now the fresh conditions would further generate inflation and crush the poor, burdening them with additional taxes besides chocking the country’s economy.

Although final bail out deal has not been struck yet the poor and middle classes have already started feeling the pinch of this punishing deal. Electricity and gas have become costlier while prices of petroleum products have hit new highs.

Noted economist, Dr Qaiser Bengali, correctly argues that the IMF has one-point agenda in Pakistan: privatization of all the assets (resulting in large-scale unemployment). It is feared that after selling off all the national assets to foreign conglomerates, the government would also sell off the natural resources. Ironically, the IMF is striking this deal with its people, apparently representing Pakistan, but in the service of the IMF.

With few exceptions, throughout the history, the economic bosses of Pakistan have been either imported from the International Financial Institutions or named by them. But this time even a common man believes that the IMF has virtually taken over the driving seat of Pakistan economy.

The consequences would be disastrous. There is no study available to prove that the IMF assistance proved beneficial to any country. This new economic arrangement would push the country in a perfect debt trap, leaving little space for Pakistan to assert its sovereignty even in the future.

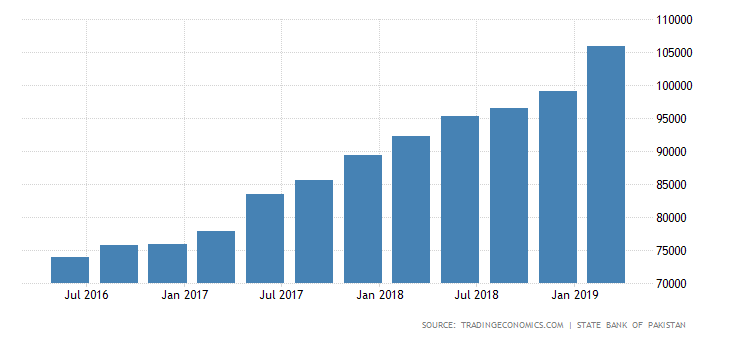

Size of Debt:

According to Pakistan’s finance ministry, the debt repayments are likely to swell by $31 billion in the next seven years. The $31-billion public external debt repayments from July 2019 to June 2026 have been worked out on the basis of $74 billion external public debt as of end-February 2019.

The debt that Pakistan will contract in the next eight years, including from the IMF, is not part of these internal estimates of the finance ministry.

The $31 billion figure includes $25.6 billion in principal loan repayments while $5.5 billion will be paid as interest on previous debt. An amount of $10 billion would be returned to multilateral lenders, excluding the IMF. The World Bank-related obligations amount to $4.8 billion and the Asian Development Bank will be returned $4.5 billion.

This is a horrific picture for a country like Pakistan with its economy in complete disarray. There is a strong likelihood that majority of these loans will be repaid by contracting new loans. The IMF bailout may help revive economy for the time being. But such a ‘revival’ is a recipe for an economic disaster in the longer run.

The state has no qualms in passing on the burden of debt on to the working classes. The rich are out of the tax tentacles as 85% of revenue is collected through indirect taxation. When 56% population is crawling below the poverty and 5.5 million children out of school, how far poor can be further burdened?

For a sustainable solution, there is strong need for an unbiased crackdown on tax-evasion by bringing the rich into tax net. Most important step will be an accountability of the previous loans acquired by the political and military regimes. An independent parliamentary debt audit commission is prerequisite to determine what loans were used for, whether the people of Pakistan have benefitted and to help ensure any future loans are used responsibly.

Last but not least, the said set of proposed solutions is next to impossible unless people of Pakistan understand the machinations of the international financial institutions (IFIs). They have to take to the streets and amplify their voice for Debt and Economic Justice.

In the word of Henry Ford, “It is well enough that people do not understand the banking system, for if they did, I believe there would be a revolution before tomorrow morning”.