The consequences of IMF and World Bank policies have been traumatic for the people of South. They have increased poverty and inequality, deprived poor nations of their crucial resources, and directed their wealth towards the North. They have long played the central role in carrying out neoliberal offensive aimed at integrating the economies of the South by bringing about institutional changes in trade, export-oriented growth model, finance and technologies.

There is a growing realization that conditionalities attached to multilateral loans are a threat to the democratic rights of the people in debtor countries, and erode their control over their own resources. The structural reforms promoted by the IMF and the World Bank have dismantled the state’s regulation capacities, while reinforcing the neoliberal plunderers through a complex set of debt politics.

Empirical evidence confirms that the policies of IMF and World Bank have aggravated the debt issues of poor countries. External debt payments by developing country governments grew by 85% as a proportion of government revenue between 2010 and 2018. It is not wrong to believe that both institutions have lost their credibility. After seven decades, they have failed to deliver the mandate to stabilize the global economy and promote long-term economic development and poverty reduction by helping countries in distress. Contrary to their mandate, they have been responsible for multiple global debt crises in different periods.

For instance, in 1960 the World Bank was cognizant of a possible debt crisis. Many leaders of the Bank and General Accounting Office (GAO) highlighted the risk of a crisis, but Bank bosses kept quiet until 1973 when the crisis exploded. The situation was the same in 1980, when the World Bank deliberately feigned ignorance in the face of the looming debt crisis, which finally burst in 1982. When the crises materalized, they never bothered to review their methodology, and instead accused the indebted states of having not applied their recommendations.

Not only that, the IMF and World Bank often oblige the countries in crisis to borrow from other sources in order to avoid default on their repayments. Before lending them new loans at higher interest rates, the future lenders generally seek IMF guarantees to which it happily agrees based on certain conditions. Thus, the entire politics of bailouts have led to cruel effects on poor countries. The consequences of these structural adjustment policies are unforgivable, with terrible effects on the poor nations.

The failure of the IMF and World Bank in terms of human development is not difficult to understand, but it is the inevitable outcome of their actions. It is absurd to believe that the purpose of the Bretton Woods Institutions is to develop nations and combat poverty. Instead, we must understand that these institutions exist to serve predatory capitalism.

If we look at the constitutions of the IMF, the main areas of intervention are surveillance, financial support and technical assistance. Section 2 of the IMF’s statute calls for the promotion and maintenance of high levels of employment, but in reality the IMF’s policies negate its mission and undermine full employment, even in the North. Similarly, section 3 of Article 6 of the statute stipulates that “members may exercise such controls as necessary to regulate international capital movement”, but in reality the IMF has always favoured complete liberalization of capital flows.

The IMF and Pakistan

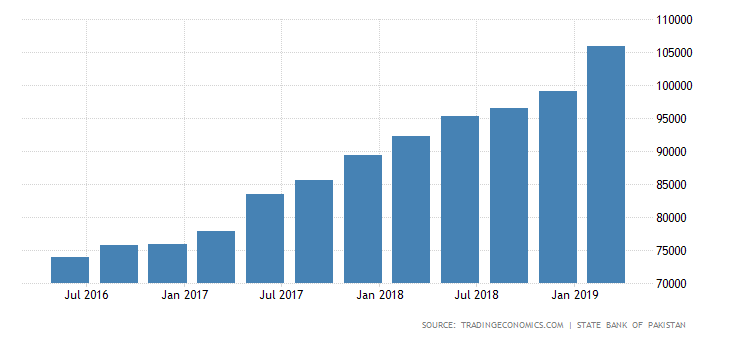

Over the past 40 years Pakistan has frequently approached the IMF for standby loans, adjustment facility (adjustment lending) and economic stabilization packages. Every time, the loans by the IMF were accompanied by a structural package that involved meeting tough targets for economic stabilization. Since 1958, Pakistan has secured 21 loans from IMF, 12 of which were bail outs. Overall Pakistan has borrowed more than $27 billion.However, these IMF programs did not achieve their objectives, particularly during the period 1988-2013. Even then, successive governments still opted for more IMF prescriptions. The main reason was that, besides the balance of payment problem, the government wanted to get a ‘seal of approval’ for seeking commercial and export credit facilities from other international finance institutions (IFIs). In this context, a new bailout package is currently under discussion, at a time when Pakistan is facing a debt trap.

Pakistan’s public debt currently stands at 71.4 % of GDP, but the IMF believes the public debt is sustainable. On the other hand, our own Finance Minister says that “Pakistan’s basic debts are so big that we are near bankruptcy”. This is why Pakistan is knocking at the door of the IMF and is likely to secure a bailout package of between $6 billion and $12 billion.

A cursory look at the IMF programs in Pakistan suggest a temporary improvement in macroeconomic performance, achieved artificially because of short term boost in foreign exchange reserves. Whatever progress was made, this was quickly reversed after the program ended.

Between 1990 and 2011, Pakistan’s interest payments averaged 17% of government revenue – more than public spending on health care. However, despite being impoverished and heavily indebted, the country was excluded from the IMF and World Bank HIPC debt relief scheme for arbitrary reasons. Perhaps the most shocking aspect of IMF and World Bank support has been their instrumental role propping-up various military governments in Pakistan, in contravention to the norms and ethics of the UN Human Rights principles.

Pakistan has been a member of the World Bank since 1950. Since then, the World Bank has provided $42.7 billion of assistance ($33.4 billion in loans/credits and $9.3 billion in grants). Today the World Bank wields its power by penetrating into local bureaucracies and gaining access into the decision-making apparatus of the state. This resembles a paradigm shift from its earlier project-based role to a more powerful policy making role, influencing the state decisions in favor of the its agenda.

Through such strategies, the World Bank is able to have influence down to the level of municipalities by offering public private partnerships (PPPs) and other alluring schemes. The World Bank’s policy influence is so great that all of Pakistan’s central bank governors between 1988 and 2009 were employed by either the IMF or World Bank in the past, and have played key roles shaping the country’s economic, financial and monetary policies for more than two decades.

Today the World Bank is crushing the poor with high interest rates by offering micro-credit through local partners, and promoting PPPs in health and education sector. If all of this multilateral support was having a positive effect on development, Pakistan would not rank 150th out of 189 countries in the Human Development Index (HDI).

The overall impact has been disastrous for the living and social conditions of workers and poor people in Pakistan. Foreign loans have weakened the economy, eroded the currency, decreased the buying power of the masses, and promoted the interests of the elite. Pakistan is currently unlikely to meet many of the Sustainable Development Goals (SDGs), including on hunger, education, gender equality, child and maternal mortality and access to basic sanitation. High debt payments, and cuts in government spending, make it more difficult for the state to provide decent quality public services such as healthcare and education.

IMF programs are designed to extract as much as possible from working people, to pay for a crisis created by big business and international finance capital. Inflation is rising to an all time high due to the continued devaluation of currency, and subsidy cuts and taxes will increase the cost of living unbearably in a country where the masses are already living in dire poverty.

In a nutshell, the Bretton Woods Institutions have lost their legitimacy and need to be replaced with more radical alternatives that are based on the principle of democratic accountability. The new global institutions, whatever they are called, must have radically different missions from the redundant Bretton Wood Institutions.

It is essential to bring an end to structural adjustment programs and instead adopt regionally centered models of development which ensure transparency of loan agreements and confirm democratic control of debt policies. It is also essential to monitor the activities of the global financial institutions and critically examine all the financial deals they strike with debtor countries.