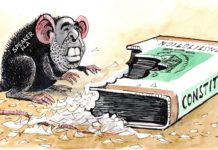

IT is now the PTI-government’s turn to announce an amnesty scheme. They’re offering non-filers of tax returns an opportunity to whiten their undeclared assets at home and abroad and get into the tax net. Facing revenue shortfalls, successive governments have used such schemes as a common tool for fundraising — making a mockery of regular taxpayers and return filers. Pakistan is one of the leaders in offering such schemes – a total of 10 so far.

The PML-N, in its last tenure, announced four such schemes to select groups. Starting with a 2014 investment scheme by then Prime Minister Nawaz Sharif, with not very encouraging results. It is surprising though for the PTI to succumb to such demands because it has been criticizing such schemes passionately when in opposition.

Rejecting an amnesty scheme offered by then Prime Minister Shahid Khaqan Abbasi in April last year, PTI chief Imran Khan had said: “Such schemes are created to benefit the corrupt. Only corrupt elements become the ultimate beneficiaries. This is to fool the honest people of the country and encourage corrupt elements to plunder and amass wealth, only to whitewash it later on.”

In fact, he had gone to the extent of pledging not only to reverse the scheme but also to investigate those benefiting from it, if he was voted to power. Former Finance Minister Asad Umar had also been very critical of amnesty schemes. “It is a joke with the nation. Those who plunder the nation’s wealth are being given relief. The only objective is to whiten the stolen money,” he said last year.

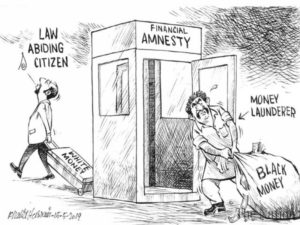

An honest tax payer pays 25% of income but now a thief, a looter will pay merely 4% to take the benefit of the stealing. What lesson does this give to the nation, steal and don’t pay taxes? This seems to be the drop scene of accountability done by PTI. Our documented economy is in the hands of elites who have strong bonds with our politicians and top bureaucracy. Subsequently, they get subsidies and other privileges and make hefty profits and stash them abroad. Politicians on the other hand, do political deficit spending by securing hefty loans to earn votes. Bureaucracy earns in conjunction with politicians and business elites and all the fallback is on the middle and poor class. Things are getting out of hands fast, indecisiveness and U-turns will lead to a point where IMF and friends’ loans shall perish into drain being dug out now.

There are parallels between theft of electricity and theft of treasury (i.e. not paying due taxes). Both are done by those who are resourceful and corrupt. Amnesty for such people is meaningless. The only stick government has is the use of existing laws before any amnesty-like bells and whistles. Did previous amnesty schemes in this country produce any positive result? Only those had benefited who had violated law of land. And who are they? –Friends and families of those in power. How can repeating the same elicit different results? Just because this scheme is formulated by a PTI government? Instead of amnesty, enforce writ of the government. Government must realize they have authority? What use is it if it is implemented? Amnesty to crooks is no proper use of authority. The launching of these various tax amnesty schemes is a disturbing sign of the confused and directionless movement of the concerned authorities.

With such moves people’s faith in Imran khan’s vision for a new Pakistan is challenged when he prefers to follow the previous government’s footsteps. Giving a clean chit to tax evaders is the beginning of weakening the ‘rule of law’.